Information to be published at least quarterly

Part 2.1 Paragraph 28-29 – Expenditure exceeding £500

The Parish Council must publish on a quarterly basis details of each individual item of expenditure that exceeds £500. This includes items of expenditure, consistent with Local Government Association guidance, such as:

- individual invoices

- grant payments

- expense payments

- payments for goods and services

- grants

- grant in aid

- rent

- credit notes over £500, and

- transactions with other public bodies.

Salary payments to staff normally employed by the Parish Council should not be included. However, details of payments to individual contractors (e.g. individuals from consultancy firms, employment agencies, direct personal contracts, personal service companies etc) are published here.

Part 2.1 Paragraph 30 – Government Procurement Card Transactions

The Parish Council must publish details of every transaction on a Government Procurement Card.

For each transaction, the following details must be published:

- date of the transaction

- local authority department which incurred the expenditure

- beneficiary

- amount19

- Value Added Tax that cannot be recovered

- summary of the purpose of the expenditure, and

- merchant category (eg. computers, software etc).

Holme Valley Parish Council does not currently make use of a Government Procurement Card

Part 2.1 Paragraph 31-32 – Procurement Information

Invitations to tender

The Parish Council must publish details of every invitation to tender for contracts to provide goods and/or services20 with a value that exceeds £5,000. For each invitation, the following details must be published:

- reference number

- title

- description of the goods and/or services sought

- start, end and review dates, and

- local authority department responsible.

Holme Valley Parish Council has invited no invitations to tender in the current Council Year

Existing and ongoing contracts

The Parish Council must also publish details of any contract, commissioned activity, purchase order, framework agreement and any other legally enforceable agreement with a value that exceeds £5,000. For each contract, the following details must be published:

- reference number

- title of agreement

- local authority department responsible

- description of the goods and/or services being provided

- supplier name and details

- sum to be paid over the length of the contract or the estimated annual spending or budget for the contract25

- Value Added Tax that cannot be recovered

- start, end and review dates

- whether or not the contract was the result of an invitation to quote or a published invitation to tender, and

- whether or not the supplier is a small or medium sized enterprise and/or a voluntary or community sector organisation and where it is, provide the relevant registration number.

Information to be published at least annually

Part 2.2 Paragraph 35-37 – Local Authority Land

Holme Valley Parish Council must publish details of all land and building assets including:

- all service and office properties occupied or controlled by user bodies, both freehold and leasehold

- any properties occupied or run under Private Finance Initiative contracts

- all other properties they own or use, for example, hostels, laboratories, investment properties and depots

- garages unless rented as part of a housing tenancy agreement

- surplus, sublet or vacant properties

- undeveloped land

- serviced or temporary offices where contractual or actual occupation exceeds three months, and

- all future commitments, for example under an agreement for lease, from when the contractual commitment is made.

Information about the following land and building assets are to be excluded from publication:

- rent free properties provided by traders (such as information booths in public places or ports)

- operational railways and canals

- operational public highways (but any adjoining land not subject to public rights should be included)

- assets of national security, and

- information deemed inappropriate for public access as a result of data protection and/or disclosure controls (eg. such as refuge houses).

Details about social housing should not be published. However, information about the value of social housing stock contained in a local authority’s Housing Revenue Account does need to be published for the social housing asset value dataset.

For each land or building asset, the following information must be published together in one place:

- Unique Property Reference Number

- Unique asset identity – the local reference identifier used by the local body, sometimes known as local name or building block.

- There should be one entry per asset or user/owner (eg. on one site there could be several buildings or in one building there could be several users floors/rooms etc – where this is the case, each of these will have a separate asset identity). This must include the original reference number from the data source plus authority code

- name of the building/land or both

- street number or numbers – any sets of 2 or more numbers should be separated with the ‘-‘ symbol (eg. 10-15 London Road)

- street name – this is the postal road address

- post town

- United Kingdom postcode

- map reference – local authorities may use either Ordnance Survey or ISO 6709 systems to identify the location of an asset, but must make clear which is being used. Where an Ordnance Survey mapping system is used (the grid system) then assets will be identified using Eastings before Northings. Where geocoding in accordance with ISO 6709 is being used to identify the centre point of the asset location then that reference must indicate its ISO coordinates

- whether the local authority owns the freehold or a lease for the asset and for whichever category applies, the local authority must list all the characteristics that apply from the options given below:

for freehold assets:

- occupied by the local authority

- ground leasehold

- leasehold

- licence

- vacant (for vacant properties, local authorities should not publish the map reference or full address details, they should only publish the first part of the postcode).

for leasehold assets:

- occupied by the local authority

- ground leasehold

- sub leasehold

- licence.

for other assets:

- free text description eg. rights of way, access etc.

- whether or not the asset is land only (i.e. without permanent buildings) or it is land with a permanent building.

Part 2.2 Paragraph 38-41 – Social housing asset value

The Parish Council must publish on at least an annual basis details of the value of any social housing stock that it holds.

The following social housing stock data must be published:

- valuation data to be listed as a full postcode (e.g. PO1 1**), without indicating individual dwelling values, and ensuring that data is not capable of being made disclosive of individual properties, in line with disclosure protocols

- valuation data for the dwellings using both Existing Use Value for Social Housing and market value (valued in accordance with guidance) as at 1 April. This should be based on the authority’s most up to date valuation data at the time of the publication of the information

- an explanation of the difference between the tenanted sale value of dwellings within the Housing Revenue Account and their market sale value, and assurance that the publication of this information is not intended to suggest that tenancies should end to realise the market value of properties.

The valuation data and information must be published in the following format:

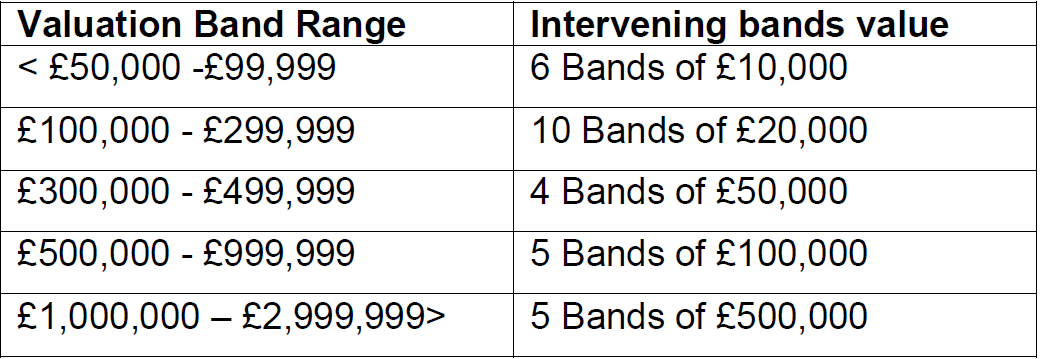

- for each postal sector level, the valuation data should be classified within set bands of value. Authorities must set their valuation bands within the general parameters set out in the table below, in light of the local characteristics of the housing market in their area, in order to ensure that valuation data published by all authorities is consistent and clear to understand:

- authorities should ensure that any band should only include values that fall within the band parameters (i.e. not give a top value band). If that is the case, the lowest and highest band should be further disaggregated

- authorities should bear in mind that it is likely that the numbers of properties in the lowest and highest bands will be low, leading to potential disclosure problems.

- for each postal sector level, within the set band of value, the data should indicate:

- the total number of dwellings

- the aggregate value of the dwellings and their mean value, using both Existing Use Value for Social Housing and market value, and

- the percentage of the dwellings that are occupied and the percentage that are vacant

- authorities must publish the valuation data for both tenanted and vacant dwellings.

Holme Valley Parish Council holds no social housing assets at 1st April 2022

Part 2.2 Paragraph 42-43 – Grants to voluntary, community and social enterprise organisations

The Parish Council must publish details of all grants to voluntary, community and social enterprise organisations. This can be achieved by either:

- tagging and hence specifically identifying transactions which relate to voluntary, community and social enterprise organisations within published data on expenditure over £500 or published procurement information, or

- by publishing a separate list or register.

For each identified grant, the following information must be published as a minimum:

- date the grant was awarded

- time period for which the grant has been given

- local authority department which awarded the grant

- beneficiary

- beneficiary’s registration number

- summary of the purpose of the grant, and

- amount.

Part 2.2 Paragraph 44 – Organisation chart

The Parish Council must publish an organisation chart covering staff in the top three levels of the organisation. The following information must be included for each member of staff included in the chart:

- grade

- job title

- local authority department and team

- whether permanent or temporary staff

- contact details

- salary in £5,000 brackets, consistent with the details published under paragraph 48, and

- salary ceiling (the maximum salary for the grade).

Because no current member of staff has a salary over £50,000, this information is not disclosed.

Part 2.2 Paragraph 45 – Trade Union facility time

The Parish Council must publish the following information on trade union facility time:

- total number (absolute number and full time equivalent) of staff who are union representatives (e.g. general, learning and health and safety representatives)

- total number (absolute number and full time equivalent) of union representatives who devote at least 50 per cent of their time to union duties

- names of all trade unions represented in the local authority

- a basic estimate of spending on unions (calculated as the number of full time equivalent days spent on union duties by authority staff that spent the majority of their time on union duties multiplied by the average salary), and

- a basic estimate of spending on unions as a percentage of the total pay bill (calculated as the number of full time equivalent days spent on union duties by authority staff that spent the majority of their time on union duties multiplied by the average salary divided by the total pay bill).

None of the current staff of Holme Valley Parish Council are at present members of a union

Part 2.2 Paragraph 46-47 – Parking account and Parking spaces

Parking Account

The Parish Council must publish on its website, or place a link on their website to this data if published elsewhere:

- a breakdown of income and expenditure on the authority’s parking account. The breakdown of income must include details of revenue collected from on-street parking, off-street parking and Penalty Charge Notices, and

- a breakdown of how the authority has spent a surplus on its parking account.

The Parish Council has no parking account and receives no revenue collected from on-street parking, off-street parking and Penalty Charge Notices

Parking spaces

The Parish Council must publish the number of marked out controlled on and off-street parking spaces within their area, or an estimate of the number of spaces where controlled parking space is not marked out in individual parking bays or spaces.

The Parish Council has no marked out controlled on and off-street parking spaces within its area

Part 2.2 Paragraph 48-49 – Senior Salaries

The Parish Council is required to publish, under the Accounts and Audit Regulations 2015 (Statutory Instrument 2015/234):

- the number of employees whose remuneration in that year was at least £50,000 in brackets of £5,000

- details of remuneration and job title of certain senior employees whose salary is at least £50,000, and

- employees whose salaries are £150,000 or more must also be identified by name.

In addition to this requirement, the Parish Council must place a link on its website to these published data or place the data itself on their website, together with a list of responsibilities (for example, the services and functions they are responsible for, budget held and number of staff) and details of bonuses and ‘benefits-in-kind’, for all employees whose salary exceeds £50,000.

Holme Valley Parish Council has no employee earning more than £50,000/a

Part 2.2 Paragraph 50 – Constitution

The Parish Council is already required to make its Constitution available for inspection at their offices under section 9P of the Local Government Act 2000. The Parish Council must also, under this Code, publish their Constitution on their website.

Holme Valley Parish Council: Constitution

Part 2.2 Paragraph 51-52 – Pay Multiple

Section 38 of the Localism Act 2011 requires the Parish Council to produce Pay Policy Statements, which should include the authority’s policy on pay dispersion – the relationship between remuneration of chief officers and the remuneration of other staff. Guidance produced under section 40 of that Act, recommends that the pay multiple is included in these statements as a way of illustrating the authority’s approach to pay dispersion.

The Parish Council must, under this Code, publish the pay multiple on their website, defined as the ratio between the highest paid taxable earnings for the given year (including base salary, variable pay, bonuses, allowances and the cash value of any benefits-in-kind) and the median earnings figure of the whole of the authority’s workforce. The measure must:

- cover all elements of remuneration that can be valued (eg. all taxable earnings for the given year, including base salary, variable pay, bonuses, allowances and the cash value of any benefits-in-kind)

- use the median earnings figure as the denominator, which should be that of all employees of the local authority on a fixed date each year, coinciding with reporting at the end of the financial year, and

- exclude changes in pension benefits, which due to their variety and complexity cannot be accurately included in a pay multiple disclosure.

Information to be published once only

Part 2.3 Paragraph 54 – Waste Contracts

Local authorities must publish details of any existing waste collection contracts they hold. Local authorities must publish this information at the same time as they first publish quarterly procurement information.

Holme Valley Parish Council has no existing waste collection contracts

Information recommended for publication

Part 3.1 Paragraph 68: Fraud and Irregularities

It is recommended that the Parish Council should go further than the minimum publication requirements set out in Part 2 and publish:

- total number of cases of irregularity investigated

- total number of occasions on which a) fraud and b) irregularity was identified

- total monetary value of a) the fraud and b) the irregularity that was detected, and

- total monetary value of a) the fraud and b) the irregularity that was recovered.